During a merger or an acquisition, businesses have a lot to focus on. Amid negotiations, regulatory compliance, and personnel issues, your brand, and how it is protected, can get overlooked. However, making sure your intellectual property is protected and your brand is understood are vital to ensuring your overall M&A strategy is sound.

The first step is a review of all the brand assets at play, which should be done as part of the due diligence process. From there, it’s important to identify opportunities to consolidate brands or, if necessary, shed identities that are redundant or potentially damaging. There are several factors to consider in deciding whether it’s worth it to maintain multiple brands at once and choose which brands to invest in.

Incorporate Branding Into Due Diligence

While negotiating a merger or acquisition, businesses should add brand-specific requests to their intellectual property (IP) due diligence requests. While a traditional IP due diligence request may ask for trademarks, domain names, and hashtags, consider adding:

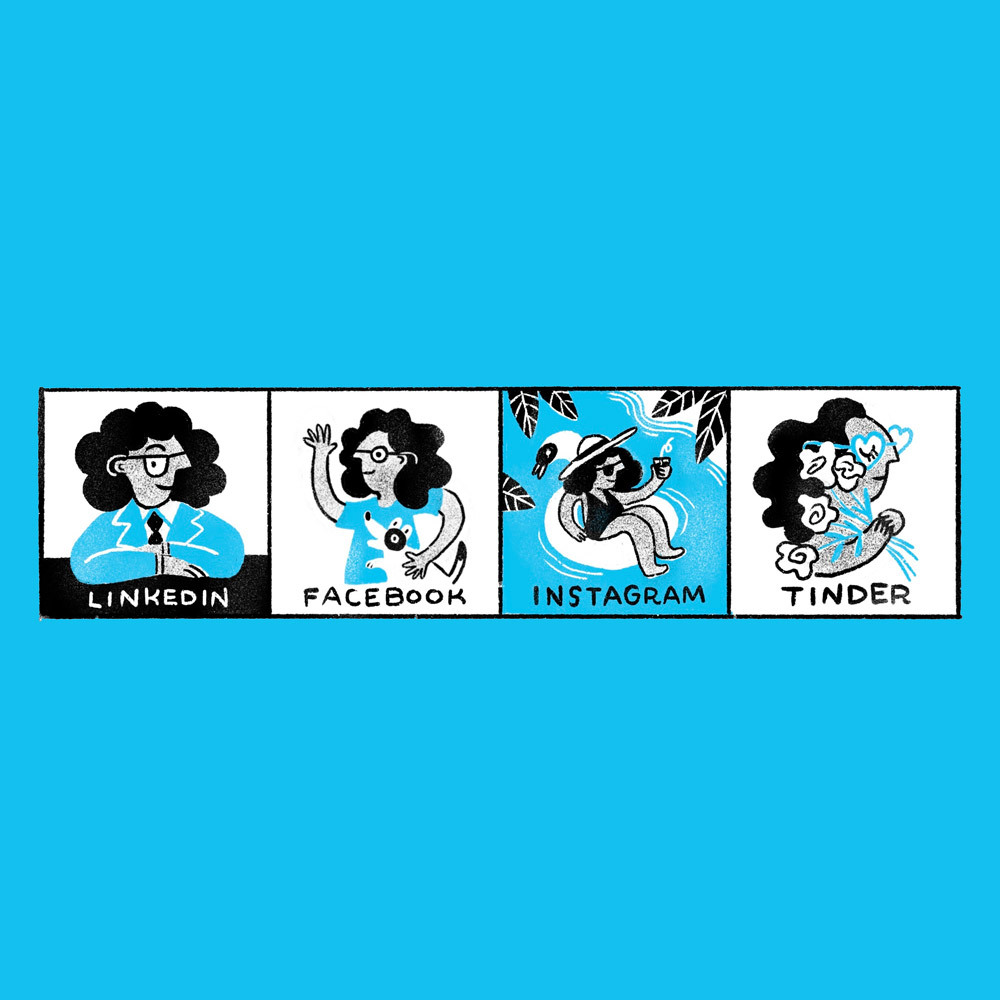

• Social media usernames and pages.

• Brand name, brand positioning, style guidelines, and brand collateral.

• Brand reputation in the marketplace and consumer loyalty drivers and competitive advantages.

To see what your full IP due diligence request list could look like, click here to view an example from Parker Poe.

You can also consider performing an audit of the brands at play and the competition. This enables you to see how the brands currently stack up and uncover areas you may be able to capitalize on after the transaction closes.

Establishing Brand Architecture

As you take stock of your new brand portfolio, the next step is to work through your brand architecture. A sturdy brand architecture removes hurdles to operational efficiency by creating a clear hierarchy of brands and eliminating redundancies.

In an acquisition, one company or brand usually gets consumed, while a merger is typically seen as a union of equals with neither side wrestling for dominance. To avoid a power struggle, you must understand your customers’ mindset and how each portfolio brand addresses their needs. It’s also important to be objective in determining which brand provides the most value, even if it is not your legacy brand.

If both brands are in the same industry and provide the same value to customers, they can be consolidated into a single identity. For example, T-Mobile and Sprint, both cell service providers, recently merged to be T-Mobile.

If brands are in different industries or provide different values to customers, customers may be confused and brands may suffer, so maintaining separate identities may be best. For instance, Red Hat has continued to coexist with IBM even after IBM acquired Red Hat last year.

Or, if the brand being acquired already enjoys significant equity, it can remain as a separate entity under new ownership. Like when Apple acquired Beats by Dr. Dre – Beats continued to use its branding even though Apple also sells the well-known AirPods. Similarly, Disney bought Marvel Entertainment in 2009. You may have not even known because Marvel has such a strong brand that has continued to exist even after Disney acquired it.

By making decisions while thinking about the customer and how it interacts with the brands in question, you can ensure your merger or acquisition will proceed with a stable brand architecture in place.

Though it may feel like a painstaking exercise amid more pressing matters, measuring the health of your brand portfolio makes plain sense when you’re involved in a merger or acquisition. An established brand architecture and clear brand value both play a pivotal role in getting the most out of your newly merged or acquired business.

Published in partnership with Parker Poe. Co-written by Jeff Cunningham and Sloan Carpenter.